Care Fee Planning - The Issue!

With an ever-ageing population, it is becoming more and more common for us to end up requiring care in our later years. A common statistic says that as many as 1 in 4 of us will require and care, and for many of us, the funding for that care will come directly from our own estate.

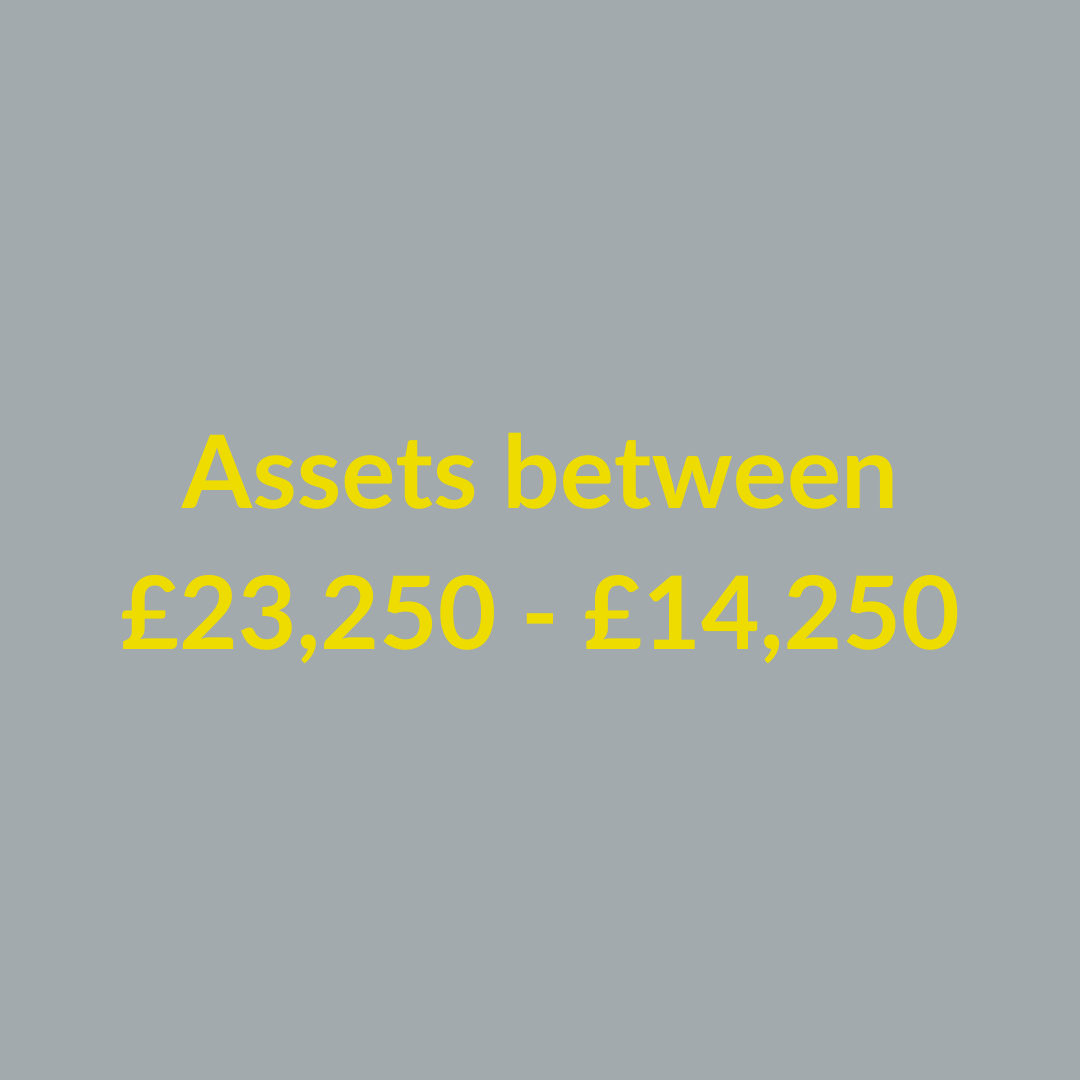

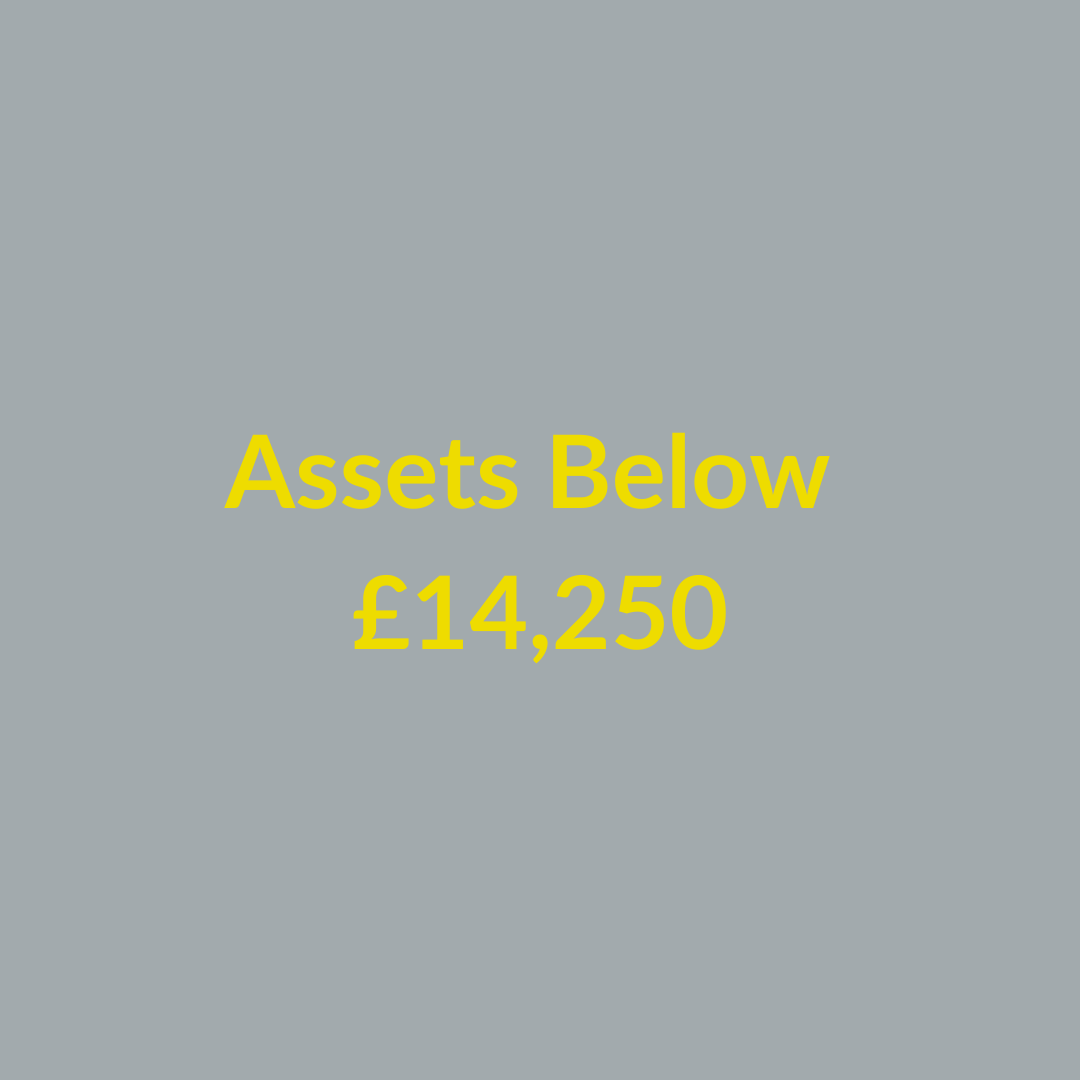

There are 3 main categories that we fall into when funding our care:

70,000 Homes Sold Every Year to Fund Care:

It is estimated that 70,000 homes are sold each year to fund long term care. Simply put, if you own a property, you will very likely fall into the first category. Should you need care, your savings will be used first, but once they have dried up, your property may need to be sold to release the funds.

Deliberate Deprivation of Assets:

There is an age-old myth that says transferring ownership of your property into your children’s names will avoid paying for long term care fees, this IS NOT true. If your local authority believe you have deliberately deprived yourself of an asset to avoid paying care fees, they will still come after you (or your children) for the fees.

The Solution:

At ORCA Will Writers we have the expertise and experience to advise you on the best course of action regarding care fee planning. Through partnerships with financial planning institutes and the correct drafting of your Will, we are able to utilise all aspects of estate planning to ensure that your loved ones receive as much of your hard-earned money as possible; without jeopardising your level of care if it is ever needed.

One thing is for certain, the sooner you get this sorted, the less likely you are to lose your estate to fund any future care you may need.

contact us

With a free consultation, we can help to educate you on why a Will can help you and your loved ones.

Get in touch to start the conversation and see just how easy it is to tick this job off your to-do list.